Jason Adolph (FRFG-intern)

On 5 December 2025, the German Parliament (Bundestag) passed a new pension package that furthers the impression that Germany is a gerontocracy. Policies are made for older people rather than for young people and future generations. In his book, Marcel Fratzscher, the polarising president of the left-leaning German Institute for Economic Research (DIW), states that 84 per cent of German citizens believe that future generations will live worse lives than their parents. This blog post seeks to stocktake recent developments in German pension and public finance policies and assesses their implications for future generations.

Pensions in Germany: The intergenerational contract

The German Pension System is based on an intergenerational contract. Working younger people pay for the pensions of older people. This is called the Umlagesystem (pay-as-you-go principle). The demographic trends are putting the intergenerational contract under pressure because of an increasingly ageing population. The arithmetic is straightforward: fewer contributors must finance more pensioners (see population pyramid, chart 1).

In the future, the distribution will be even more skewed towards pensioners. In the 1960s, there were 19 pensioners per 100 people in the working force. Now there are 34. It is predicted that there will be 50 per 100 by 2030 and even 65 per 100 in 2060. The current demographic development places pressure on the German pension system to be reformed. However, much-needed reforms appear to be pushed back into the future.

The German pension reform 2025 – why is it generationally unjust?

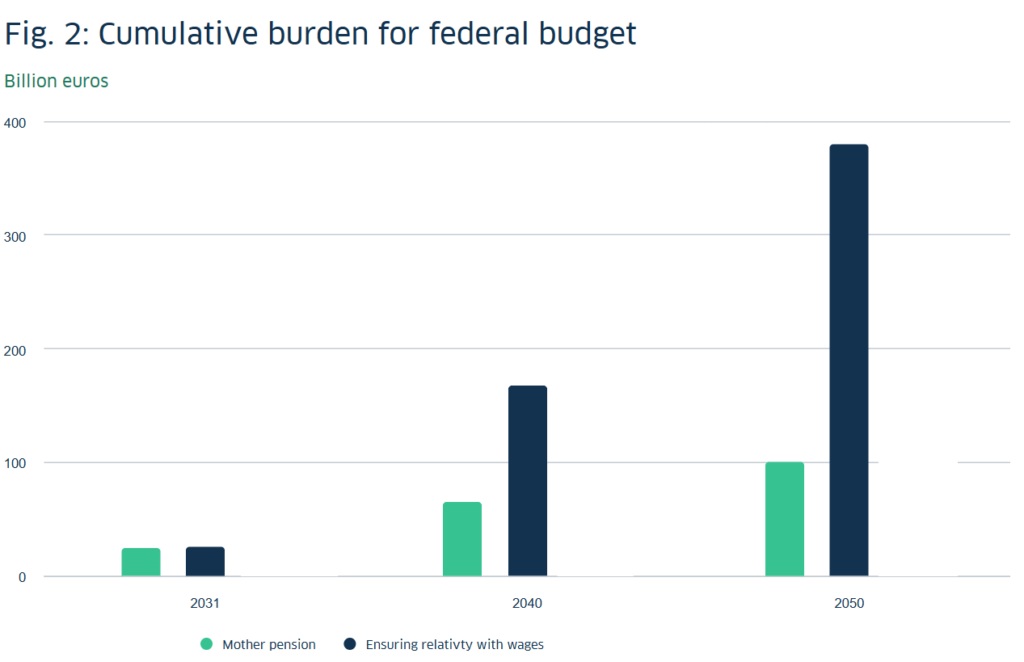

The pension package passed by the Federal Government encompasses, firstly, a stabilisation of the benchmark pension level at 48 per cent of the average income until 2031. The benchmark ensures that pensions do not rise more slowly than average income, so that pensioners also benefit from economic growth. Secondly, it extended the ‘Mütterrente III’ (Mother’s Pension III) to women whose children were born before 1992. Mothers will receive an equivalent for staying at home instead of working per child per month for 36 months. This will lead to an immediate cost of an additional five billion euros annually (see chart 2 below, green column). Finally, it introduced the ‘Aktiv-Rente’ (active pension) in which employees at pension age can earn up to 2000 Euros tax-free if they continue working, but they must pay insurance contributions. The economic impact of this is not certain for now.

Projected costs until 2031, 2040 and 2050 for stabilisation of the benchmark pension level at 48 per cent and the Mother Pension in the German Pension Law 2025.

As the illustration indicates, the new pension package would impose additional burdens of up to 480 billion euros on the regular federal budget until 2050. This estimation is shared by the German Taxpayers Federation, a lobby organisation that is a prominent voice on national debt. This cost is financed through German tax revenue. The ifo-Institute, an economic research facility that aims to shape economic discussions in Germany, calculated that, in the 2026 budget, the state subsidy for the statutory pension scheme will consume one-third of the overall regular budget, with the trend being upwards. The recently passed pension package is an illustration of gerontocratic policy: it provides immediate benefits to pensioners while pushing financial burdens into the future. Consequently, it is intergenerationally unjust.

Rising interest payments on incurred public debt, estimated to be 15.7% of the tax revenue share in 2029, will further strain the regular budget.

Both together will limit future generations’ liberty to make spending decisions with their money.

Shifting burdens into the future: pressure on young and future generations

The ‘Junge Gruppe’ (young group), members of the CDU/CSU Bundestag faction who belong to the parties’ respective youth organisation ‘Junge Union’ (young union), threatened not voting for the bill due to the burdens it imposes on future generations. For them, the necessity to stabilise the pension level benchmark at 48 per cent until and beyond 2031 was not apparent. There have been reports that the CDU/CSU faction leader, Jens Spahn, placed the Young Group under significant pressure and threatened to lower their position on electoral lists for the upcoming elections. Even though this is not confirmed, the younger generation was subjected to immense pressure to accept a pension package that increases financial burdens on younger generations, displaces reform into the unknown future and, ultimately, limits their freedom to make decisions and future investments.

Earlier in 2025, the Bundestag decided to create a debt-financed special fund of 500 billion euros for infrastructure and climate-neutrality projects that will run over the next decade. Additionally, it reformed the debt brake. This reform allows the Federal Government to take on new debt of 180 billion euros for 2026. The goal of the generational borrowing was to increase investment and boost economic growth that could not be covered in the regular budget. A recent study by the Institute of the German Economy (IW) found that, until 2029, almost every second Euro from the special fund will be used for other purposes and not for additional investments. This means that, instead of investing in the future with infrastructure, high-tech, or renewable energy projects, the money is reallocated to relieve the regular budget. One example is the support for Germany’s railway company Deutsche Bahn (DB). The special fund had earmarked 18.8 billion euros to support DB. Simultaneously, the regular budget’s contribution to the railroad network will shrink by 18.7 billion euros.

If the expected boost to the German economy does not materialise, this historic gamble with the special debt will not pay off. The special fund could have had a significant impact on future generations if additional investments had truly been made to create new capital (such as a new hydrogen pipeline network) that would be passed on. Then it would also be just if future generations paid interest on the capital they benefit from. However, due to the poor utilisation of the special fund, future generations will face dilapidated infrastructure and greater financial burdens from debt repayment. This is another example of gerontocratic policy: instead of financing future projects, the money is used to create space for electoral gifts in the regular budget, such as the mother’s pension III.

What is the outlook for the rights of future generations?

It appears as if the current generation of politicians falls into the same habit that plagued German governments before: “Not in my term of office.” Instead of introducing necessary pension reforms in the so-called ‘Herbst der Reformen’ (autumn of reforms), the German government establishes expert commissions on the pension system and the debt brake. Meanwhile, the government implements policies that provide immediate benefits to older generations, increasing the likelihood of being re-elected. The current pension and public finance policies are examples of gerontocratic policies that favour older generations at the expense of future generations.

Since it is difficult to know what future generations need, at least we should provide them with a future in which they can make their own decisions. The political choices regarding pensions and public finances in Germany leave little hope that future generations will be provided with this freedom. We should ask ourselves: how much longer can we push burdens into the future until our actions limit the freedom of future generations to such an extent that they cannot act at all, but must only repay for our mistakes and lack of reform will?

Further Reading:

English:

Pension Systems

Public Finances

Publications in German:

SRzG-Positionspapier Renten und Pensionen (5. Auflage, Mai 2025)

SRzG-Positionspapier Erwerbstätigenversicherung

SRzG-Positionspapier Staatsverschuldung und Investitionen

Blog posts in German:

https://generationengerechtigkeit.info/aktuell/geplante-rentenkommission/

https://generationengerechtigkeit.info/aktuell/schluss-mit-dem-theater/

https://generationengerechtigkeit.info/aktuell/koav-alterssicherung/

https://generationengerechtigkeit.info/aktuell/boomer-soli/

https://generationengerechtigkeit.info/aktuell/lars-klingbeil/

https://generationengerechtigkeit.info/aktuell/pp-rente-pensionen/

https://generationengerechtigkeit.info/aktuell/reform-der-abgeordnetenpension-im-naechsten-bundestag/

https://generationengerechtigkeit.info/aktuell/pm-rentenpaket-2024/